Lexington’s Cyteir Therapeutics to Close Two Years After IPO

A Lexington-based biotech firm, Cyteir Therapeutics Inc., has declared its plan to disband a mere two years following its public debut via an IPO.

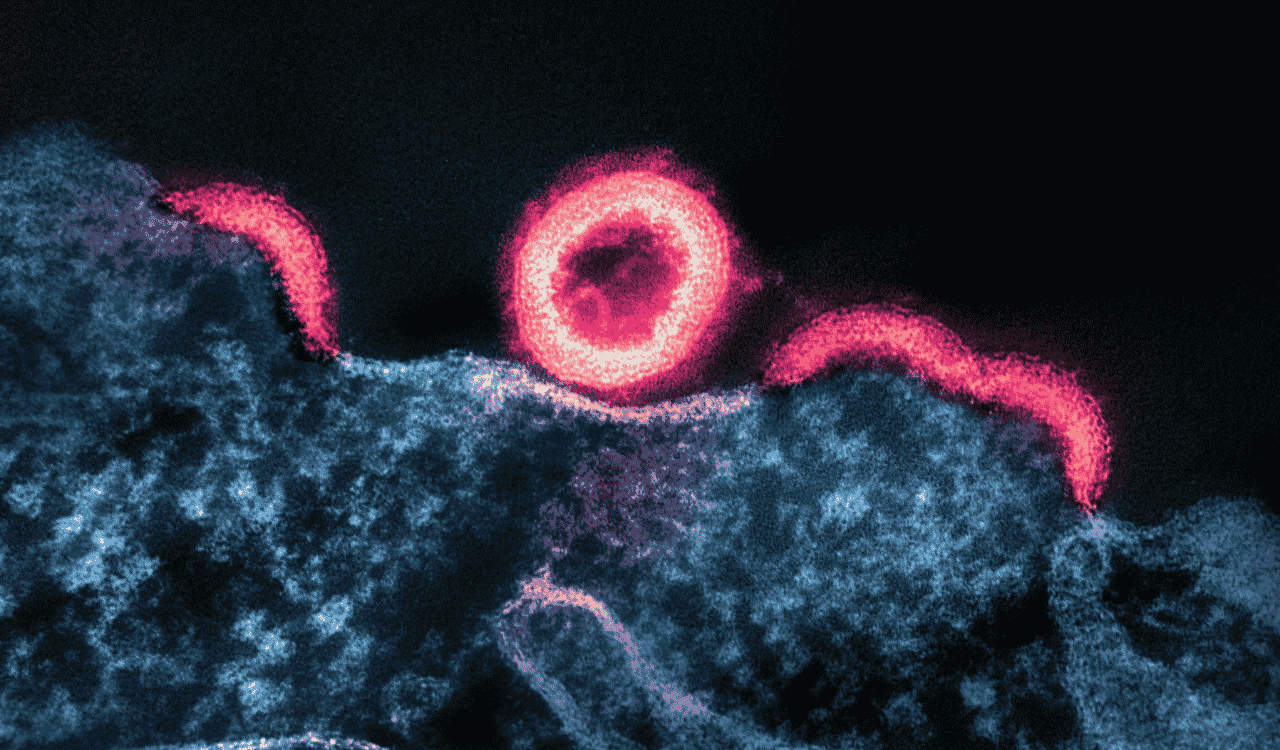

The company’s announcement on Friday included intends to cease the development of its solitary drug, a clinical-stage program designed to treat ovarian and other solid-tumor cancers. Cyteir aims to liquidate its resources, dissolve the company, and disburse the remaining cash to shareholders.

The announcement comes after the company had previously let go of about 70% of its workforce – roughly 35 individuals – earlier this January. At that time, all preclinical activities were suspended to devote all resources to developing their ovarian cancer drug, CYT-0851.

Shareholders have responded favorably to the decision to liquidate, with the company’s stocks experiencing a surge of nearly 40% to $2.67 per share by Friday afternoon. This surge increased the company’s market capitalization to $95.2 million.

Cyteir CEO, Markus Renschler, thanked everyone involved with the company over the years.

He stated, “We would like to thank the patients who enrolled in our trial, the staff at our clinical trial sites, all employees of Cyteir, the Board of Directors, and our investors who have supported Cyteir over the years. While we wish the outcome were different today, we believe that discontinuing our programs and dissolution of the Company will maximize shareholder value.”

Patients currently part of the Phase 1 study of CYT-0851 will be allowed to continue on the drug until the company’s official dissolution. This dissolution will be enforced once the company files a certificate of dissolution and conducts a special shareholder meeting to discuss the company’s wind-down, slated to happen before the end of the year.

Cyteir had followed a similar path to other cash-strapped biotech firms in January, favoring a more advanced drug candidate over its early-stage work. The hope was that the clinical data generated could provide a fundraising boost and bring the drug closer to commercial viability. However, CYT-0851 proved less effective than anticipated and needed more resources to modify the drug or target better-suited patients.

At the end of March, Cyteir reportedly had cash reserves of $132.7 million, according to its most recent quarterly report. The company has also reported a loss of $12.5 million for the second quarter.

During the biotech IPO boom of 2021, Cyteir debuted on the Nasdaq, raising $133 million on its first day. However, as the IPO momentum has slowed down and cash has become increasingly scarce, critics have questioned the prudence of early-stage drug companies launching IPOs prematurely, particularly before they have human data to leverage.